#Wave bookkeeping free software

Wave Accounting is free accounting software that was launched in 2010. Tenant-friendly features like these may help to reduce tenant turnover and increase cash flow, assuming that satisfied tenants will pay their rent on time and take better care of the property if they plan on staying for the long term. There are options for marketing vacancies, screening tenants and signing a lease, collecting rent, and managing maintenance requests entirely online. In addition to tracking income and expenses, and assets and liabilities, many property management software systems have features to help a rental property run more smoothly, efficiently, and profitably.

#Wave bookkeeping free full

Property management software solutions such as Avail and TenantCloud combine rental property accounting with a full suite of tools a landlord can use to manage rental property. In addition to making life easier, financial reports also look much more professional, which can be important when applying for a loan or putting together information for a buyer. Most accounting programs can also be connected with a business bank account, so that income and expenses are synced with the software, although it may still be necessary to review transactions and ensure they are being posted to the correct accounts. One big advantage is that, in addition to tracking income and expenses, accounting programs also use a balance sheet and automatic double-entry accounting.įor example, when a tenant rent payment is deposited, the checking account balance is increased and the rent receipt is also recorded as rental income on the profit and loss statement (P&L). With the exception of Stessa, which is specifically designed for real estate investors, these other off-the-shelf accounting software systems will require some initial time and effort to customize for real estate investing. Because data has to be manually entered, it’s possible to overlook an expense that could end up being a valuable tax deduction.Īccounting programs such as Stessa, FreshBooks, QuickBooks, or Xero are the next step up for rental property accounting. While using spreadsheet software for rental property accounting may be the path of least resistance, a worksheet can become less useful as time goes on. There are many rental income and expense worksheets available online, like this one.

Having a worksheet that’s already set up saves the time and trouble of having to do tedious tasks such as creating row and column headings and making sure that each formula is calculating correctly. One of the nice things about using an electronic spreadsheet is that there are plenty of pre-made templates for a real estate investor to use. Spreadsheet software programs like Microsoft Excel, Numbers, Google Sheets, or OpenOffice are used by tens of millions of people around the world and can be an easy way to set up a rental property accounting system.

There are the four main ways for handling rental property accounting:

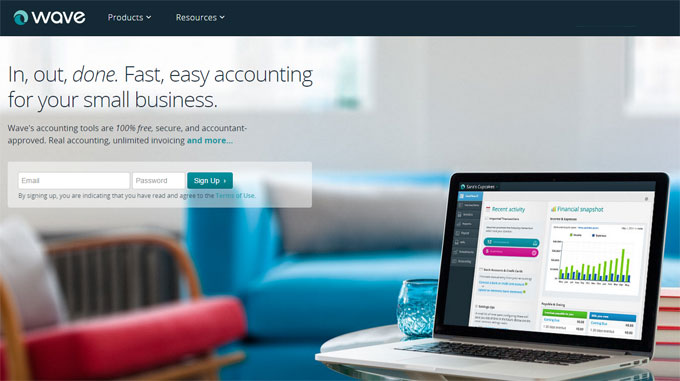

Rental property accounting software options In this article, we’ll take a look at Wave Accounting for landlords, and discuss the pros and cons of using the software for rental property. And after all, who wants to pay more taxes than they have to? Unintentionally underreporting income can lead to penalties and fines in the event of a tax audit, and overlooking a valuable deduction can result in a tax bill that’s higher than necessary. It’s important to have a system in place to track income and expenses, and assets and liabilities, even for investors who have just one rental property.

0 kommentar(er)

0 kommentar(er)